Fixed Rate Vs Conventional Mortgage. On a fixed rate reverse mortgage b. Both fixed and adjustable rate mortgages have their own benefits, but one may make.

A second question in our mind is should we just do a conventional refi at 3.25% 30 year fixed and. Fixed mortgage rates and determine your corresponding monthly payment. It's a decision that will affect a homeowner for years to come and could be the difference in literally thousands of dollars of the interest cost. Interest rates for mortgages below may include up to 0.5 discount points as an upfront cost to borrowers. How to choose a mortgage.

If you read this far, you should follow us:

Fixed mortgage rates and determine your corresponding monthly payment. Shorter timeframe following major credit problems (3 years vs. Conventional loan vs fha loan. By and large, fixed mortgage rates follow the pattern of canada bond yields, plus a spread, where bond yields are driven by economic factors such as unemployment, export and inflation. Both fixed and adjustable rate mortgages have their own benefits, but one may make. Security is provided in favour of scotia mortgage corporation (smc), a wholly owned subsidiary of scotiabank, registered in first position priority on the land and building. In 2021 as the effects of coronavirus. According to caamp approximately 65% of mortgages are fixed rate. The federal reserve sets an initial rate on which banks base their interest rates. Conventional mortgages are usually best for prospective homebuyers with a strong credit history, stable income and the ability to make a down payment of at least 5%. While the marketplace offers numerous varieties within these two categories, the first step when shopping for a mortgage is. These loans are safe in many ways. Interest rates for mortgages below may include up to 0.5 discount points as an upfront cost to borrowers.

Everyone's situation is different, so it's possible an arm could still be a good fit for you. A fixed rate mortgage has a fixed mortgage rate for the entire term of the loan. These loans are safe in many ways. Adjustable rate mortgage vs fixed rate mortgage. Fha loans typically will have a lower base.

Conventional mortgages are easier to process and allow home equity to build faster, as they require higher down payments.

Interest rates for mortgages below may include up to 0.5 discount points as an upfront cost to borrowers. Refinancing out of an arm. Shorter timeframe following major credit problems (3 years vs. On a fixed rate reverse mortgage b. Adjustable rate mortgages, what's the difference? Conventional mortgages are usually best for prospective homebuyers with a strong credit history, stable income and the ability to make a down payment of at least 5%. This would seem to contradict statistics that show that variable mortgage rates have generally been below fixed mortgage rates. The variable vs fixed mortgage rate decision is one of the biggest a borrower will make when selecting their mortgage. Variable rate mortgages and fixed rate mortgages have their pros and cons; Conventional loans typically come with fixed interest rates, with the option to refinance later. 7 years for foreclosure and 2 years vs. If you read this far, you should follow us: Conventional loan vs fha loan.

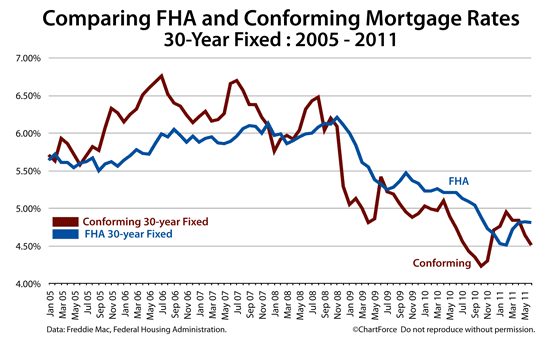

According to caamp approximately 65% of mortgages are fixed rate. Adjustable rate mortgages, what's the difference? That interest rate and mortgage balance can be assumed by a new buyer. First, let's take a quick overview of the whole fha vs. What are fha and conventional mortgage loans?

Conventional mortgages are usually best for prospective homebuyers with a strong credit history, stable income and the ability to make a down payment of at least 5%.

In 2021 as the effects of coronavirus. Let better money habits help you decide if an arm or fixed rate mortgage is best for both fixed and adjustable rate mortgages have their own benefits, but one may make more sense for your financial situation. While the marketplace offers numerous varieties within these two categories, the first step when shopping for a mortgage is. Arm vs fixed rate mortgage calculator. (in quebec, an immovable hypothec): These loans are safe in many ways. Conventional loan vs fha loan. A fixed rate mortgage has a fixed mortgage rate for the entire term of the loan. Because the rate never changes, the homeowner can budget more easily for the principal and interest portion of his housing payment. If you read this far, you should follow us: Both loans offer you flexibility in type (fixed rate vs adjustable rate) as well as term length (30 years. The federal reserve sets an initial rate on which banks base their interest rates. Shorter timeframe following major credit problems (3 years vs.